With an annual decline of almost 50 per cent in new launches and 15 per cent decline in sales across top seven cities in India, the real estate sector was effectively shattered in 2017

In 2017, the market clearly made a shift towards the affordable housing segment, with 44 per cent of unit launches (55,000 units) coming in with price tags under Rs 40 lakh. This is a major shift in the Indian real estate sector and developers are now visibly aligning their supply with the budget ranges dictated by demand, so as to avoid any mismatch.

The seed of reforms sown in 2017 will doubtlessly reap consummate benefits in the future. Although they caused disruption in the sector, these reforms serve the important purpose of eliminating unscrupulous players from the real estate ecosystem. Moreover, developers are likely to focus squarely on their core business and be customer-centric by launching the right kind of supply at the right prices.

Unsold inventory decreased by 10 per cent from 8.04 lakh units in Q4 2016 to 7.27 lakh units by Q4 2017 Fewer launches, subdued sales and muted property prices defined 2017 for the Indian residential real estate sector, according to a detailed report by Anarock Property Consultants.

“A spate of policy reforms and structural changes literally crippled the sector,” says Anuj Puri, Chairman, Anarock Property Consultants. “Simultaneously and consequentially, it transitioned rapidly into a transparent and buyer-friendly one. With only end-users left to drive the market and investors more or less evaporating completely, developers throttled back severely on new launches to allow the market more scope to absorb the already staggering unsold inventory.”

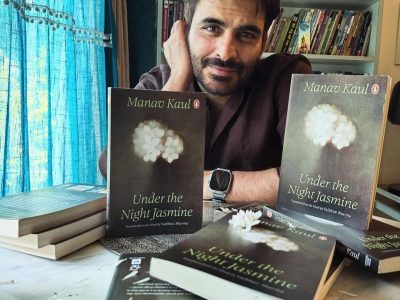

Puri is India’s most prominent thought leader in the real estate industry. He is regarded as one of the acknowledged experts on India’s real estate opportunities both in India and across the globe.

He says mounting unsold inventory and stringent RERA norms kept developers on the back foot in 2017. Not surprisingly, instead of infusing new supply in the market, developers focused on executing their under-construction projects in order to remain RERA-compliant and remain relevant in the rebooted market scenario.

The top seven cities recorded new unit launches of around 1.26 lakh in 2017 as opposed to 2.50 lakh in 2016. MMR (Mumbai Metropolitan Region) contributed the maximum fresh apartments supply with 38 per cent (48,400 units) NCR’s contribution was 18 per cent with 22,200 units Bengaluru’s contribution was 13 per cent with 16,000 units Pune’s contribution was 11 per cent with 13,800 units Chennai’s residential real estate market was the worst-affected in 2017, with an annual decline in new launches of around 72 per cent from 15,700 units in 2016 to 4,400 units in 2017 Pune, Bengaluru and Hyderabad recorded an annual decline of 67 per cent, 64 per cent and 57 per cent respectively in new launch units NCR and MMR recorded a drop of 45 per cent and 33 per cent, respectively

“In terms of sales during 2017, almost all the cities recorded a decline when compared to 2016- except Hyderabad, which recorded a 21 per cent increase,” says Anuj Puri. “The decline in sales can be primarily attributed to weak buyer sentiments amidst the rather confusing new policy environment.”

Uninspiring Sales Figures

Chennai recorded the highest dip in sales at 26 per cent — from 17,800 units in 2016 to 13,200 units in 2017 MMR sales dipped by 24 per cent — from 69,600 units in 2016 to 52,600 units in 2017 Kolkata’s sales dipped by 23 per cent — from 16,800 units in 2016 to 12,900 units in 2017 NCR’s sales dipped by 22 per cent — from 47,900 units in 2016 to 37,700 units in 2017 Pune’s sales dipped by 6 per cent — from 31,200 units in 2016 to 29,400 units in 2017 Bengaluru saw the lowest dip in sales at 2 per cent — from 43,300 units in 2016 to 42,300 units in 2017.

Restricted new launches in 2017 resulted in a significant reduction of unsold inventory levels across the top seven cities. Overall unsold inventory decreased by 10 per cent from 8.04 lakh units in Q4 2016 to 7.27 lakh units by Q4 2017. An uptick in the traction of ready-to-move-in and nearing-completion properties helped developers to clear a lot of the existing stock. Prices across the top seven cities remained largely range-bound in 2017, primarily due to the presence of significant unsold stock and cautious buyer sentiments.