Exports of buffalo meat, a huge earner of foreign exchange for India, have been hit as demand for the product in other countries has fallen

MEAT, ESPECIALLY buffalo meat, is one of the most wanted exports out of India but Covid-19 seems to be inching closer to destroying its prospects. Along with several other items which have been affected, the virus has led to severe dearth of demand.

This is going to hit the companies exporting the product and also, of course, the economy. To understand just how big the buffalo export market is, look at Agricultural and Processed Food Products Export Development Authority (APEDA) figures. In 2018-19, buffalo meat in the quantity of 11,22,856.46 metric tons at a value of Rs 23,185 crore was exported.

And this is not an anomaly. Look at the years before that, when in fact numbers were better. In the year 2017-18 the country exported 12,47,724 metric tons of bovine meat at a value of Rs 24,401.27 crore and the year before that in 2016-17 the quantity exported was 12,58,531.95 at a value of Rs 24,993 crore.

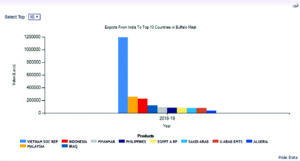

The top importer for India’s export meat was Vietnam in 2018-19 which imported 5,65,853.96 metric tons of meat, followed by Malaysia which imported 1,24,413.15 metric tons then Indonesia at 94,500 metric tons. The top ten importers of the meat included Iraq, Philippines, Saudi Arabia, UAE and lastly Algeria.

But with airports closing their doors, the impact is being felt by traders.

Delhi-based Azam (name changed, as he wishes to remain anonymous), says now just about 30% of shipments are being done due to the Coronavirus. “They have stopped taking the shipments into their countries, so our goods are unable to pass through. We used to send fresh meat on flights and with them being suspended we are massively

affected.”

In fact, the APEDA report shows just how much meat export Delhi airport was dealing with. Just the export of buffalo meat from the Delhi airport in 2018-19 was 7,465.16 metric ton of product worth Rs 221 crores. For the year of 2019-2020 (April to Dec) its export was 4976.95 metric tons worth Rs 143 crore.

Azam’s products destined for Dubai, Saudi Arabia, Muscat, and Bahrain have all been affected. “Only a few countries are taking shipments. And this will affect our business and our workers. When there’s no work a person will stay and see for about a month but after that what will happen. We don’t know, there is a lot of uncertainty.”

He says that in the case that they usually earn Rs 1 crore a month from exports, they are now barely able to make Rs 30 lakh.

But he does point out that his business has seen a downturn since the Yogi Adityanath government came to power in Uttar Pradesh in 2017. Azam says he closed his factory down in UP the same year. “I don’t understand our government’s policies. It doesn’t deal directly with China to export meat, if they do, our country would make so much more profit.”

At present, meat shipments from India to China mostly go via Vietnam and the Philippines.

To bring the focus back on the current predicament, which is the Coronavirus and its impact on exports, an official with APEDA was quoted in reports as saying that there is already 12-15 per cent decline in meat exports. On top of that, falling global demand for rice, restrictions on outbound shipments of medicines and a shortage of raw material for the pharmaceutical, solar and electronic industries.

A report in Times of India had stated that the loss of exports had so far reached a whopping Rs 1,500 crore.

The Federation of Indian Export Organisations (FIEO) President Sharad Kumar Saraf has said that the spread of Covid-19 to over 144 countries is going to mark the most challenging time for the export sector. And it certainly looks to be so.

No longer busy as bees

The Coronavirus has also affected exports of fruit and vegetables, and rice along with several other products.

While in the case of meat, closure of borders and cancellations of flights have hit exports, there are also other reasons at play. One such example is of Queenbee food, exporters of honey.

Amit Gupta, director of the company which mainly exports honey to the US, followed by Europe and the Middle East, points to two factors which have impacted their trade. One is that lab tests of their honey are unable to be conducted and second is the non-availability of empty containers.

The downfall started mid-February. “We get the testing of our product at a laboratory in Germany which is now unable to fulfil the testing on time because of the strength in their office falling sharply. So, we are not getting the results on time”. While earlier a batch would take 10 days to be tested it is now taking 17 days. “We are not sure if they will continue testing or they’ll do a complete shutdown of their lab”.

Secondly, the impact on imports has directly affected his company’s exports. “Lot of Indian imports have become impacted because of which containers from China and Europe are not coming to India. So when import is not happening, we are not getting the empty containers to export our goods.”

The containers come about five days late but their number has dwindled. Where earlier they were able to procure 400 containers and thus export them, now, Gupta says they will barely be able to procure and thus send 50% of the product.

“Our work will come to a standstill, we expect, in the next two weeks. It’s going to impact us very badly”.